PMS HARYANA [wcyear] : For any Updation/Correction required in property details after YASHI company survey,It came into picture that there are multiple property units where surevey was done in wrong way.

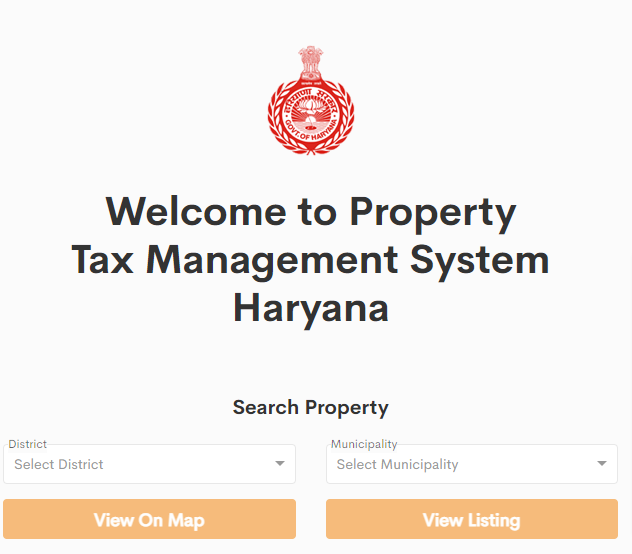

For the purpose of correction in Property Units Dr. Kamal Gupta. Hon’ble Urban Local Bodies Minister started the Property Tax Management System Haryana where citizens of haryana can search Property according to their District> Select relevant property and if found mistakes then apply for modification.

Please read the following instructions given in PMS HARYANA PORTAL…

For any modification in tax parameters /name /address, please fill the details here with the legally valid document as proof for consideration.

- (Online Updation) : For any updation in survey data use 8 Digit New ID on https://pmsharyana.com portal to update your property information

- If you are not comfortable with online process then only the desired amendments / changes from the information shown in the notice sheet, enter only the correct information related to, and this part of the information sheet along with the documents is attached with the information letter in the corporation / committee office.

- Check the photocopies of the documents and put them in the drop box and get your receipt.

Information Sheet for Property ID in HARYANA STATE:

| Old ID | Colony Name | Land-mark | Pariwar Pahchan Patra | House/ Property No |

Use (Self/Rented) |

Mobile Number |

Owner Name | Occupier Name |

S/D/W Of Sh. | Number of Floor | Floor (B2/GF/1/2F..) |

Property Category (Building Use) |

Property Type | Carpet Area (Sq. Feet) | Remark if any |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Important Information Regarding the Form, Please read carefully:

This information is based on a fresh property survey.

Some mismatch in the Old ID and the New ID may be Information Form. Therefore, the property details and the tax details are given in the Information Form need to be carefully checked and verified and if required, necessary corrections are got done.

This is only a Information Form and not the actual property tax bill. The assessed tax will be issued separately after 30 days, incorporating amendments if any.

In future, the property tax of your property tax shall be evaluated with respect to the OLD and NEW ID mentioned in this Information Form is mandatory to be checked, verified and satisfied.

Any updation requirred is to be submitted either online or offline within 30 days of the issuance of this Information Form.

If you are not satisfied with the details of property survey mentioned in this Information Form, then you may register on the PMS portal (PMSHaryana) or login through mobile based OTP and 8-digit ID provided and submit the request for updations required along with the documentary proofs such as Registry, Photo ID, allotment letter/sale deed.

In the absense of documentary evidence, the guidance will not be carried out.

This Information Form is not valid for ownership proof.

This Information Form carries only the property tax for the FY 2021-22, otherwise the balance dues will be added in property tax Notice of FY 2022-23

If you want to get the updations done by visiting the office of the Municipal body, then tear off the assessment-Information Form from the giving marking on the previous page. The lower part of the assessment – Information Form is to be submitted in the office of the Municipal body along with the documentary proofs.

If you do not claim the claim, then only the details shown in the Information Form will be considered complete and final. No objection later on will be entertained.

I want to upload my mother’s registered will with following Property IDs No.

1. 6NDJL9J9

2. 6NK9NMV7

3. 6NAV2936

4. 6NEKUNA3

MCF FARIDABAD IS MOST CARELESS. IT”S WORK IS HARRASSING PEOPLE.

I HAD NEVER SEEN THIS TYPE OF WRONG ASSESSMENT IN LIFE