Steps to change Property Tax Ownership in Faridabad

How do I find my Property Tax property ID?

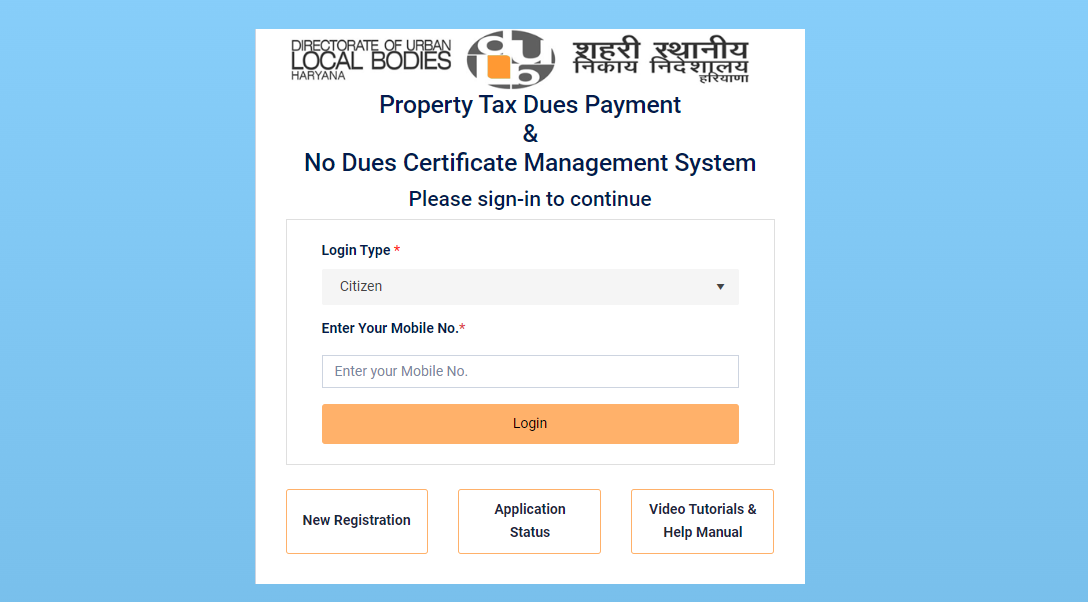

Many people don’t know how to change property tax ownership. As you know property tax submission process of Haryana is completely online, citizens can find their Property Tax Property ID by visiting the Official website of Urban Local Bodies on the online portal i.e. No Dues Portal. The steps to get the Property Id are:

- Visit https://ulbhryndc.org/.

- Select Login type as Citizen as you are a citizen.

- Enter your mobile number and click on login.

- If you are not registered to access the No Dues Portal then click on New Registration. Fill up the necessary details like Name, Father Name/Husband Name, and Mobile number.

- After entering the mobile number click on the login button, and you will receive an OTP on the registered mobile number, dashboard will be opened.

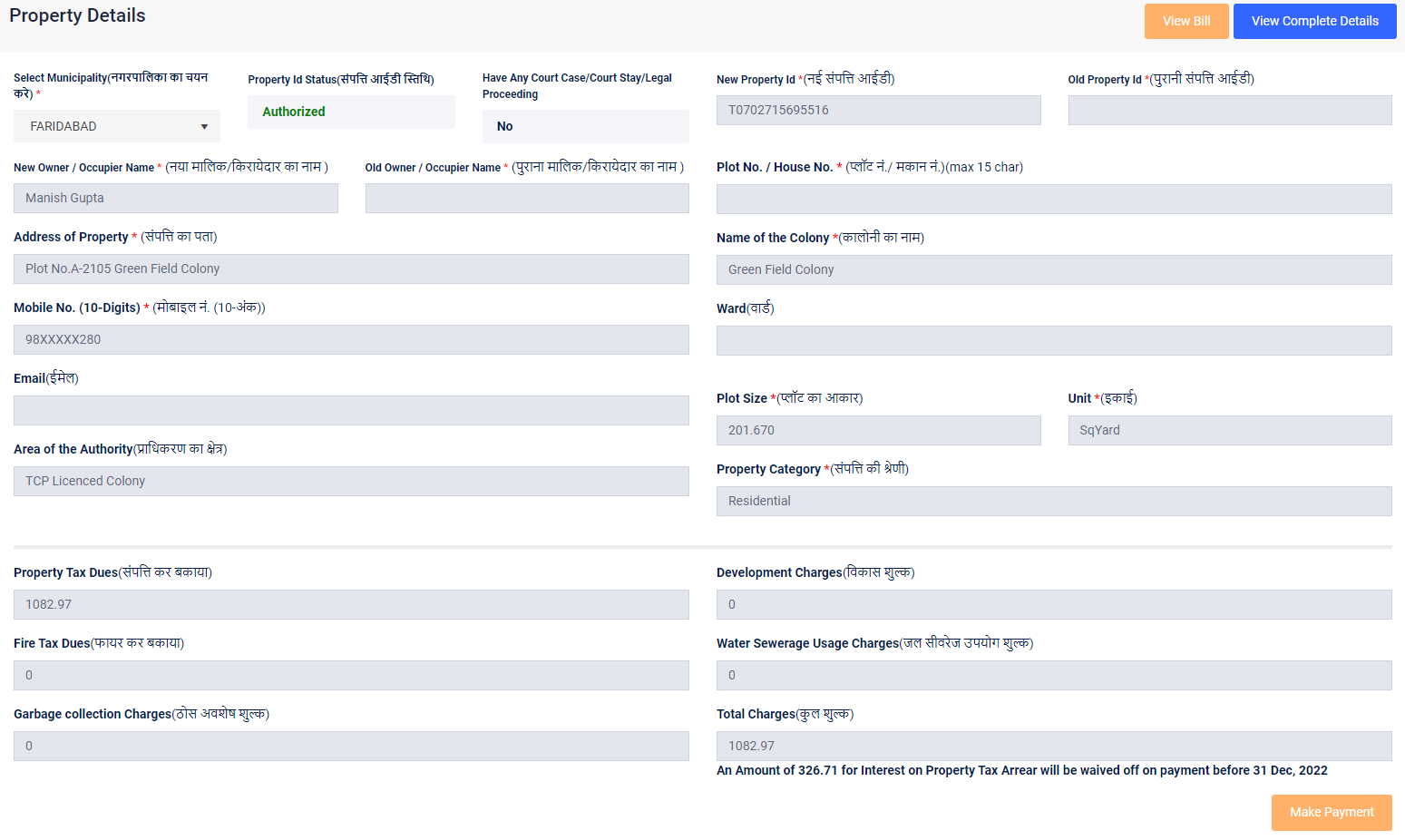

- Select District, Select Municipality as these both are mandatory and enter any one of necessary details like Search By Property Id,Search By Owner / Occupier Name and even you can search with Property ID By Mobile No and click Search.

- Click on Raise objection.

- Attach required details like:

-

- Receipts of taxes that have been paid last year or current year.

- Chain of Property Papers.

- Attested copy of the Sale deed or deed of sale transaction which is in owner name.

- Self attested ID proof.

These documents are required to have been submitted Online. After the reports and application are submitted and confirmed, the change will reflect in the records after the approval within15 days (under RTS).

Approval Process for Property Tax Ownership change.

- Citizen will receive an Application number for the Objection Raised at https://ulbhryndc.org/.

- Enter your Application Number and click Check Status.

- You will get the details of your application status weather Approved from First level i.e. Assistant/Clerk of concerned Zone. then from second level i.e concerned zonal taxation officer.

- Approval for ownership change is given to all the applicants who had provided all required details while applying raise objection after defining certain fees.

- Citizen will receive status via SMS that raise objection is approved.

- Now Citizen, have to login to No Dues Portal and Pay the fees for Name change ownership.

- On making payment ,changed ownership is reflected on the portal and then you can download NDC and use the NDC certificate where ever it is required whether for Loan from bank or for any other process.

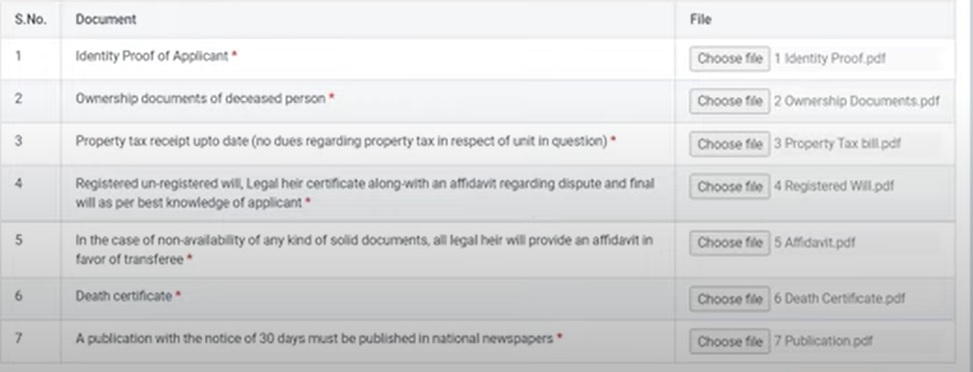

Name change of Ownership for Death Case

-

- Identity Proof of Applicant.

- Ownership Documents of deceased person.

- Property tax receipt upto date (no dues regarding property tax in respect of unit in question).

- Registered un-registered will, Legal heir certificate along with an affidavit regarding dispute and final will as per best knowledge of applicant.

- In the case of non-availability of any kind of solid documents, all legal heir will provide an affidavit in favor of transferee.

- Death certificate.

- A publication with the notice of 30 days must be published in national newspapers.